Nvidia Dominates AI Chip Market with Record Revenues

Nvidia is revolutionizing the AI chip market with record revenues and innovative Blackwell technology, propelling the future of artificial intelligence.

Key Points

- Nvidia

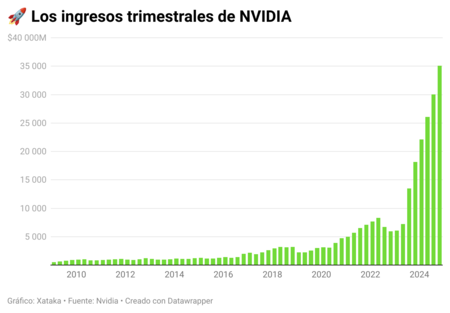

reported a record revenue of $35.08 billion, marking a 94% year-over-year increase driven by surging demand for AI chips.

- The launch of the Blackwell chip family positions Nvidia at the forefront of the AI revolution, with demand expected to exceed supply for several quarters.

- Despite potential supply chain challenges, Nvidia continues to play a pivotal role in shaping the future of artificial intelligence technologies.

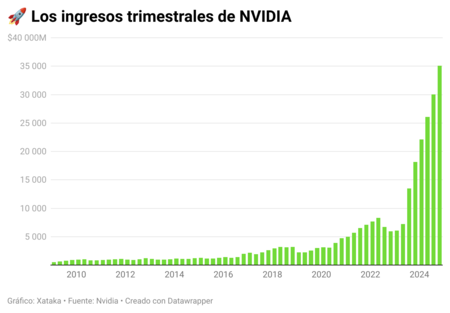

In an era marked by rapid technological advancements, few companies have managed to redefine their industries as dramatically as Nvidia. With the surge in demand for artificial intelligence (AI) chips, Nvidia's performance in recent quarters has been nothing short of extraordinary. In its latest financial report, the company posted record revenues, showcasing how integral its products have become in the expanding landscape of AI.

Unprecedented Growth in Revenue

Nvidia's latest quarterly results reveal a remarkable revenue of $35.08 billion, a staggering increase of 94% compared to the same period last year. This growth not only surpassed analysts' expectations but also solidified Nvidia's status as a trailblazer in the chip manufacturing industry. The company's net income for the quarter reached $19.3 billion, which is more than doubling its profit from the previous year.

Such impressive numbers highlight the accelerating adoption of AI technologies across various sectors. Companies are investing heavily in advanced computing capabilities, pushing the demand for Nvidia's specialized chips. The recent launch of its Blackwell chip family has further fueled this trend, as firms worldwide scramble to enhance their AI systems.

Blackwell: The Next Generation of AI Chips

Nvidia's Blackwell chips represent a significant leap forward in technology, designed to handle the complex demands of generative AI applications. As

, Nvidia's CEO, stated, “The age of AI is in full steam, propelling a global shift to Nvidia computing”. This innovative chip not only meets current demand but also sets the stage for future advancements in AI.

Despite initial supply chain challenges and production bottlenecks, Nvidia is optimistic about the future. The company has stated that demand for Blackwell will outstrip supply for several quarters, illustrating just how essential these chips are to the tech landscape. Furthermore, as the production of Blackwell ramps up, Nvidia anticipates improvements in profit margins, which will positively impact future revenue.

The Larger Impact of AI Growth

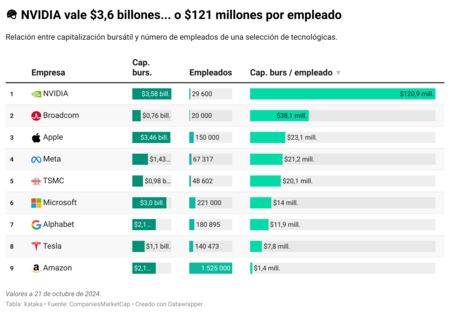

The significance of Nvidia's success extends beyond just its financial performance. The company has emerged as a crucial player in the AI revolution, akin to the role oil played in the industrial era. Its chips are powering everything from advanced chatbots to AI-driven data analysis platforms, reflecting a broader shift in how businesses operate. As the demand for generative AI products continues to grow, Nvidia stands to benefit immensely.

Analysts suggest that Nvidia's soaring stock and robust sales figures are indicative of an industry-wide trend towards heavy investment in AI technologies. The $30 billion generated from data center revenue this last quarter—a 112% increase year-on-year—underscores this movement, as cloud companies expand their capabilities to embrace AI’s vast potential.

Challenges Ahead: A Cautious Outlook

However, it’s essential to remain cautiously optimistic. While the current growth trajectory may be impressive, some analysts have voiced concerns regarding potential supply chain disruptions and production challenges. The shift from traditional chip models to advanced packaging processes necessary for Blackwell chips adds another layer of complexity that Nvidia must navigate.

As Nvidia continues to eclipse its competitors, including

and Intel, it faces both opportunities and challenges. Maintaining its momentum in a market characterized by rapid technological evolution will require strategic foresight and agility. Evaluating how Nvidia will sustain its growth amidst these complexities will be vital for investors and stakeholders alike.

Nvidia's journey over the past few quarters serves as a compelling narrative of innovation, resilience, and excellence in a fast-paced tech landscape. As the company continues to shape the future of AI, its influence on technology and business practices will be profound. With the global shift toward AI-driven solutions showing no signs of abating, Nvidia's role as a leader in this realm is likely to only expand further.