Samsung Electronics Faces Challenges in Q4 2023 Earnings

Explore how Samsung Electronics is tackling Q4 2023 challenges, from declining semiconductor profits to fierce smartphone competition in the tech landscape.

Key Points

- Samsung Electronics

reported a significant decline in Q4 2023 earnings, affected by falling semiconductor profits and intensified competition.

- The company's mobile division struggled with declining shipments and market share amid fierce competition from rivals like Apple and Chinese manufacturers.

- Despite current challenges, Samsung is focusing on innovation and emerging technologies, offering a potential pathway for recovery in 2024.

Samsung Electronics, a titan in the technology sector, recently faced a significant decline in its earnings forecast for the fourth quarter of 2023. This development has raised concerns not only among investors but also within the broader tech community about the company's future performance and strategic direction. With a reported revenue of 75 trillion won and an operating profit of 6.5 trillion won, Samsung fell short of projections, leading to a reassessment of its competitive stance in key markets such as semiconductors and smartphones.

Declining Semiconductor Profits

One of the most pressing issues for Samsung is its semiconductor division, which generated a smaller operating profit than anticipated. Estimates indicate a significant downturn with earnings declining due to a combination of oversupply and a fierce price war led by competitors such as

. Specifically, prices for DRAM chips plummeted, with average fixed prices in December reported at $1.35, down from $2.10 just six months earlier.

Furthermore, amid softening demand from traditional markets like PCs and smartphones, Samsung's non-memory sectors such as foundry and system LSI have also faced losses, compounding the overall impact on profitability. The once-stalwart semiconductor division now appears to be navigating through a difficult period dubbed the "semiconductor winter".

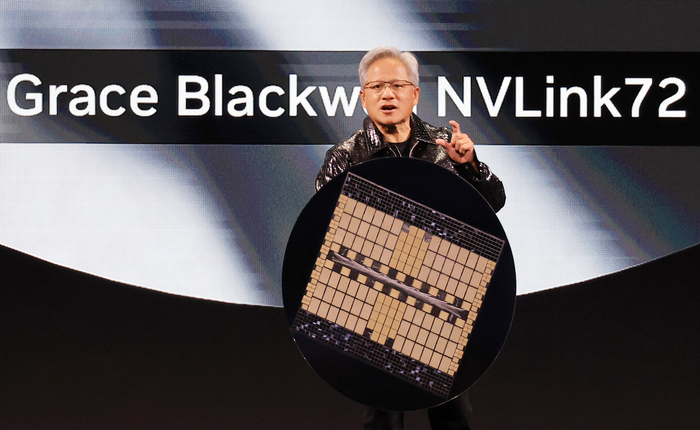

AI and HBM Supply Chain Challenges

Adding to the pressure, Samsung's ambitions in the promising high-bandwidth memory (HBM) space have not yet materialized as expected. The HBM market, significantly influenced by the AI chip demand, is critical for the company to regain its foothold against rivals. The delay in supplying the fifth-generation HBM3E modules to

has raised concerns about Samsung's ability to compete effectively in this lucrative segment.

Experts suggest that the design of the HBM3E may require revisions, slowing any potential recovery in this pivotal area.

, CEO of Nvidia, expressed confidence in ultimately securing a successful collaboration with Samsung; however, until these products are launched, Samsung's share in the HBM market may continue to dwindle.

Impact on Mobile Division and Future Outlook

The struggles are not limited to semiconductors. Samsung’s mobile division has also been feeling the effects, particularly amid declining shipments and intense competition from Apple and emerging Chinese firms. The latest Galaxy smartphone releases have not sparked the anticipated excitement, leading to a substantial impact on sales performance during the typical high season. Analysts predict that the mobile experience (MX) division's operating income will lead to further strain, hovering around the 2 trillion won mark.

Despite these setbacks, Samsung's leadership remains optimistic about potential recoveries in 2024. Analysts forecast a positive shift for the semiconductor division in the second quarter of the year, predicting that inventory adjustments and an increase in HBM shipments may help revive sales and profitability. Furthermore, improvements in the manufacturing process and a strategic pivot towards AI-integrated products may bolster their market position.

A Resilient Path Forward

While Samsung Electronics is currently facing multifaceted challenges, the company’s proactive approach to reinvigorate its product lines and adapt to market changes will be crucial. The potential for recovery is there, but it hinges on timely responses to evolving consumer needs and technological advancements. By reinforcing its commitment to R&D and focusing on emerging trends like AI, Samsung can continue to secure its place as a leader in the industry.

In summary, Samsung Electronics is navigating through a challenging landscape marked by declines in semiconductor profitability and competitive tension in its mobile division. However, with a focus on innovation and emerging technologies, there remains a possibility for revitalization and continued market leadership. The forthcoming quarter will be critical to observe how well Samsung can pivot and adapt to regain its competitive edge.